Masaki Oka

Director, Corporate Officer,

Chief of Finance & Accounting Headquarters, Chief of Corporate Planning Division

The entire Toyoda Gosei Group is striving to enhance corporate governance so that we can continue as a company of integrity that is trusted by society. To build and maintain fair and transparent corporate governance systems, we are increasing the effectiveness of the monitoring and auditing of corporate management by outside directors and Audit & Supervisory Board members, while also installing internal control systems company-wide to ensure the propriety and efficiency of work. Through Group-wide compliance activities, we are pursuing thorough legal compliance and business ethics.

We are also identifying risks with the potential to have a huge impact on our operations, and implementing risk management activities to prevent future problems.

Corporate governance

Basic philosophy

We view the enhancement and strengthening of corporate governance with the aim of ensuring sound and efficient corporate management to be crucial in achieving sustainable growth. Based on this, we are building and maintaining fair and transparent management systems and organizational systems that can respond precisely to environmental changes.

Additionally, Toyoda Gosei pursues consummate corporate governance by voluntarily implementing a range of policies in accord with the letter and spirit of the ideals and principles in Japan’s Corporate Governance Code formulated by the Financial Services Agency and the Tokyo Stock Exchange.

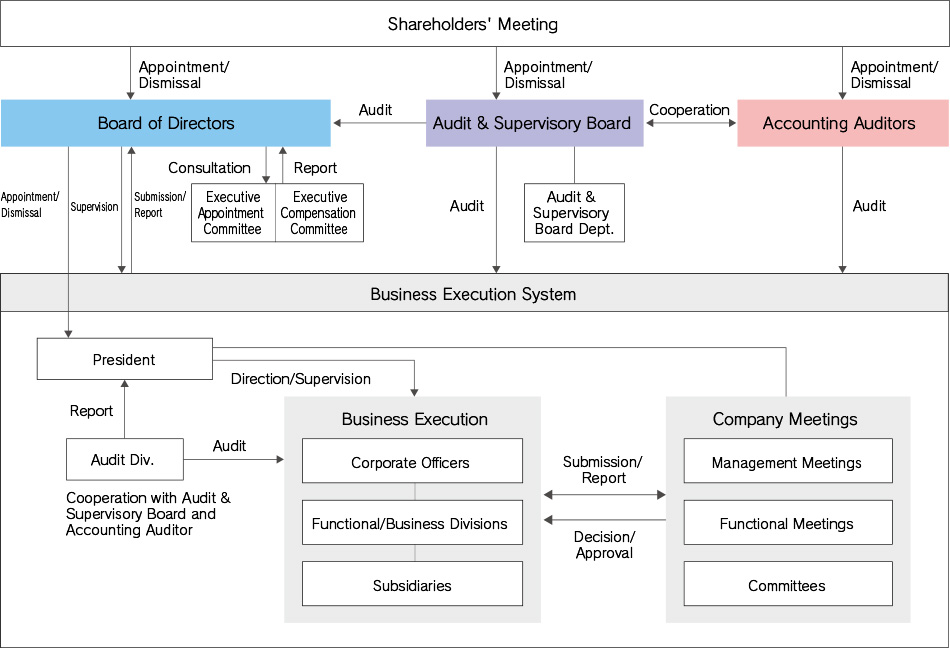

Corporate governance system

Toyoda Gosei has adopted an audit and supervisory board system and set up the shareholders’ meeting, Board of Directors, Audit & Supervisory Board, and accounting auditors as statutory entities. We have also put in place internal auditors and other internal control systems including internal audits.

The Board of Directors consists of nine directors and holds regular monthly meetings (extraordinary meetings held as needed), where matters prescribed by law or in the Articles of Incorporation and important matters related to corporate management are reported, discussed, and resolved.

A system of corporate officers is used to speed up decisionmaking and business execution. For important business matters, monthly management meetings are held. Functional meetings and committee meetings relevant to key areas such as technology, costs, and personnel are also held as needed for good management decisions.

The Audit & Supervisory Board consists of five members and holds regular meetings. Members also attend important meetings such as Board of Directors’ meetings and audit each department and subsidiary, through which they fulfill their function of auditing corporate management.

Accounting auditors are external auditors who combine auditing functions with a commitment to ensuring an independent and fair auditing system. The company adopts the current system because audit, supervisory, and execution functions are well coordinated with each other under this structure, with legality and efficiency of the company's decision-making and business execution sufficiently ensured.

Also, in order to strengthen the supervisory function of the Board of Directors and to increase the objectivity and transparency of the decision-making process, we have established an Executive Appointment Committee and Executive Compensation Committee under the Board of Directors as non-mandatory advisory committees, both of which are majority-independent and chaired by an outside director. The roles and membership of the two committees are as follows.

| Name | Role | Members |

|---|---|---|

| Executive Appointment Committee |

Deliberates and reports on proposals regarding the appointment and dismissal of directors and Audit & Supervisory Board members (Appointment of president, etc.) | Chairman Naoki Miyazaki, President Toru Koyama, Outside Director Sojiro Tsuchiya, Outside Director Kimio Yamaka (Chairperson), Outside Director Mayumi Matsumoto |

| Executive Compensation Committee |

Deliberates and reports on the compensation system for directors and their individual compensation (Restricted stock-based compensation, etc.) | Chairman Naoki Miyazaki, President Toru Koyama, Outside Director Sojiro Tsuchiya, Outside Director Kimio Yamaka (Chairperson), Outside Director Mayumi Matsumoto |

Internal control systems

In accordance with the provisions of Japan’s Companies Act, Toyoda Gosei has formulated a Basic Policy on Establishing Internal Controls. Under this policy, we are striving to ensure appropriate operations by establishing internal control systems, which help us deliberate important matters, establish related rules and guidelines, and handle internal audits, compliance and risk management. Every year, the Board of Directors checks the status of establishment and operation of internal controls in an ongoing effort to improve and reinforce them.

Internal controls for the Toyoda Gosei Group

To cultivate a healthy internal control environment at Toyoda Gosei and its subsidiaries, all Group companies share its management philosophy. The Toyoda Gosei Group Charter for Business Ethics, a shared guideline for compliance, has also been instituted and expanded to subsidiaries. While respecting the independence of subsidiary management, we receive regular business reports from subsidiaries and set up systems to confirm the propriety and legality of subsidiaries’ businesses through advance approval reports. We also send non-executive directors and Audit & Supervisory Board members to key subsidiaries in a system to monitor and act as a check on their business execution.

■Corporate governance system

■List of major company meetings

| Meeting Name | Division in Charge | |

|---|---|---|

| Management Meetings | Board of Directors | General Administration |

| Management Meeting | Corporate Planning | |

| Functional Meetings | Sales Meeting | Sales Planning |

| Technical Development Meeting | Technical Administration, Production Engineering Management |

|

| Profit and Cost Meeting | Finance & Accounting | |

| Production Meeting | Production Engineering Management | |

| Purchasing Meeting | Purchasing | |

| Human Resources Meeting | Human Resources | |

| Committees | Compliance and Risk Management Committee | Legal, Corporate Planning |

| Export Control Committee | Corporate Planning | |

| Safety and Health Committee | Safety & Health Promotion | |

| Environment Committee | Environment | |

| Quality Committee | Quality Assurance | |

Corporate Governance Report

Internal audits, Audit & Supervisory Board members’ audits, and accounting audits

We have set up an Audit Division to handle internal audits. With the aims of achieving business objectives and preventing misconduct and mistakes, internal audits are conducted across the overall business (including audits of functional departments) based on an internal auditing plan approved by management at the beginning of each term.

The results of internal audits are reported to management, and audited departments are given recommendations for improvements based on the audit results. The effectiveness of internal audits is increased by checking their improvement plans and results.

Each Audit & Supervisory Board member follows the auditing policy and audit plan established by the Audit & Supervisory Board when investigating the company and subsidiaries. They attend the meetings of important deliberative bodies and committees including the Board of Directors and management meetings, listen to reports on business from directors and others, inspect financial statements and other important documents, and conduct onsite audits of offices and subsidiaries to audit the performance of duties by directors from the perspectives of ensuring legality and appropriateness, protecting assets and rights, and preventing loss. Moreover, a special department has been established to assist the auditors’ audits.

The certified public accountants who performed the FY2019 accounting audit of Toyoda Gosei are Eiichi Yamanaka and Tomohiro Nishimura of PricewaterhouseCoopers Aarata LLC.

Audit & Supervisory Board members, internal auditing department personnel, and accounting auditors regularly meet to confirm their respective auditing systems, auditing policy, auditing plans, implementation status, and audit results. They cooperate in performing efficient and effective audits, contacting each other as needed to exchange ideas and share information.

Director (skills matrix)

| Name | Position at Toyoda Gosei |

Executive Appointment Committee |

Executive Compensation Committee |

Corporate management |

Governance | Overseas operations |

Manufacturing (production/quality management) |

Technology | Sales | Finance | Personnel | Environment and energy |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Naoki Miyazaki |

Chairman | ○ | ○ | ○ | ○ | ○ | ○ | ○ | ○ | |||

| Toru Koyama |

President | ○ | ○ | ○ | ○ | ○ | ○ | ○ | ○ | ○ | ||

| Tomonobu Yamada |

Executive Vice President |

○ | ○ | ○ | ○ | |||||||

| Hiroshi Yasuda |

Director | ○ | ○ | ○ | ○ | ○ | ○ | |||||

| Masaki Oka |

Director | ○ | ○ | ○ | ||||||||

| Takashi Ishikawa |

Director | ○ | ○ | ○ | ○ | |||||||

| Sojiro Tsuchiya |

Director Outside Independent |

○ | ○ | ○ | ○ | ○ | ○ | ○ | ○ | ○ | ||

| Kimio Yamaka |

Director Outside Independent |

◎ | ◎ | ○ | ○ | ○ | ○ | |||||

| Mayumi Matsumoto |

Director Outside Independent |

○ | ○ | ○ | ○ | ○ |

Note: “ ◎ ” denotes the committee chairperson.

Expected roles of and support for outside directors

All three outside directors possess a wealth of experience and keen insight.

Mr. Tsuchiya’s experience and expertise lie in global strategy and production engineering; Mr. Yamaka’s, in finance and the environment; Ms. Matsumoto’s, in the environment and SDGs. Ms. Matsumoto is Toyoda Gosei’s first woman director.

The three adeptly fulfill monitoring and advisory roles in addition to actively participating in Board discussions.

In their monitoring role, they receive support in the form of departmental briefings on business operations and challenges and direct access to front-line operations through on-site-visits to domestic and overseas subsidiaries to better understand the actual state of operations. Additionally, they are briefed in advance on the content and background of resolutions to be voted on at Board meetings to facilitate sound decision-making.

At the same time, the outside directors advise management on company direction and business challenges. Advisory opportunities include regularly scheduled liaison meetings attended by all outside directors and outside Audit & Supervisory Board members, each of whom attends various other meetings also, including Sales Meetings and ad hoc meetings.

Changes in numbers of directors and Audit & Supervisory Board members

In 2012, Toyoda Gosei adopted a system of corporate officers and downsized its Board of Directors to eight directors from 23 as of 2011. It appointed its first outside director in 2015.

The Board currently comprises nine directors, three or one-third of whom are outside directors. One of the outside directors is a woman. The outside director appointments have increased the Board’s objectivity and diversity.

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|---|---|---|

| Total directors |

23 | 8 | 7 | 7 | 8 | 9 | 10 | 9 | 9 |

| Outside directors (% of total) |

0 (ー) |

0 (ー) |

0 (ー) |

0 (ー) |

1 (12%) |

2 (22%) |

2 (20%) |

2 (22%) |

3 (33%) |

| Female (% of total) |

0 (ー) |

0 (ー) |

0 (ー) |

0 (ー) |

0 (ー) |

0 (ー) |

0 (ー) |

0 (ー) |

1 (11%) |

| Audit & Supervisory Board members |

5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 |

| Outside Audit & Supervisory Board members |

2 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 |

Outside directors and outside Audit & Supervisory Board members

Toyoda Gosei appointed three outside directors, Sojiro Tsuchiya, Kimio Yamaka, and Mayumi Matsumoto, at its annual shareholders’ meeting on June 12, 2020. Chika Kako was also appointed as an outside Audit & Supervisory Board member. Together with current outside Audit & Supervisory Board members Hideomi Miyake and Masami Hadama, a total of three outside Audit & Supervisory Board members have now been appointed.

■Election of outside directors and outside Audit & Supervisory Board members

| Appointment | Name | Independent director |

Reason for appointment |

|---|---|---|---|

| Outside directors |

Sojiro Tsuchiya |

○ | To reflect in Toyoda Gosei’s management his wealth of experience and keen insight gained from his career at Denso Corporation, where he served mainly in production engineering roles and was involved in management as a director. Mr. Tsuchiya has been designated as an independent director because he meets the requisite criteria and is deemed free of potential conflicts of interest with regular shareholders. |

| Kimio Yamaka |

○ | To reflect in Toyoda Gosei’s management his wealth of experience and keen insight gained from a career spent in public-sector finance and project review and the environmental/energy field. Mr. Yamaka has been designated as an independent director because he meets the requisite criteria and is deemed free of potential conflicts of interest with regular shareholders. |

|

| Mayumi Matsumoto |

○ | To reflect her extensive experience and high-level insight as a news anchor and researcher in the broad fields of social issues, environment and energy in the management of Toyoda Gosei. Ms. Matsumoto has been designated as an independent director because she meets the requisite criteria and is deemed free of potential conflicts of interest with regular shareholders. |

|

| Outside Audit & Supervisory Board members |

Chika Kako | To reflect in Toyoda Gosei’s audits her wealth of experience and keen insight gained from her career at Toyota Motor Corporation, where she served mainly in vehicle development and materials development roles and was involved in management as a managing officer. | |

| Masami Hadama |

○ | To reflect his extensive experience and deep insight in law in the auditing of Toyoda Gosei. Mr. Hadama has been designated as an independent director because he meets the requisite criteria and is deemed free of potential conflicts of interest with regular shareholders. |

|

| Hideomi Miyake |

○ | To reflect his extensive experience and deep insight as a corporate manager in the auditing of Toyoda Gosei. Mr. Miyake has been designated as an independent director because he meets the requisite criteria and is deemed free of potential conflicts of interest with regular shareholders. |

Ensuring the effectiveness of the Board of Directors

At Toyoda Gosei, the Board of Directors Office conducts annual interviews of all directors and Audit & Supervisory Board members, including outside ones, on the effectiveness of the Board of Directors. The roles and responsibilities of the Board of Directors, the level of discussions, opportunities to improve effectiveness and other matters are assessed from multiple perspectives and the results are reported to the Board of Directors. In FY2019, the Board was rated highly on a number of points, including appropriateness of matters submitted/reported on at Board meetings and sharing of information with outside directors in addition to its composition and welcoming attitude toward candid discussion, both of which were ranked highly in FY2018 also. The assessment accordingly concluded that the Board’s effectiveness increased in FY2019. At the same time, the Board still has room for improvement in certain areas. It will explore ways to further increase its effectiveness and improve on an ongoing basis.

- ・Board’s size, composition and balance between executive and outside directors

- ・Atmosphere conducive to lively discussions

- ・Limited meeting agendas that allow for ample discussion of important matters to be submitted

- ・Support for outside directors, including access to information needed for Board deliberations

- ・Clearer identification of medium- to long-term issues that should be addressed and more discussion of strategies for addressing them

- ・Faster response to urgent issues

- ・Easier-to-understand materials for Board meetings (reason for inclusion on agenda, big-picture view, relationship with business strategy, etc.)

- ・More opportunities outside of Board meetings for discussion, information sharing, etc. between outside and executive directors

Executive compensation

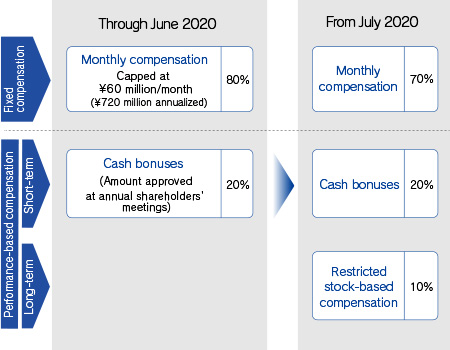

Executive compensation consists of fixed monthly compensation and performance-based compensation in accord with the idea that executives should be appropriately incentivized to pursue sustained growth in shareholder value. The performance-based compensation consists of cash bonuses (short-term incentive) and stock-based compensation (long-term incentive). The fixed monthly compensation is set at a level that reflects the individual’s job responsibilities and experience as well as compensation norms at other companies. Its base amount accounts for some 70% of total compensation, with cash bonuses (shortterm incentive) and stock-based compensation (long-term incentive) respectively accounting for roughly 20% and 10%.

Outside directors and Audit & Supervisory Board members receive only fixed monthly compensation because their role is to oversee and monitor management from an independent vantage point.

Executives’ cash bonuses are based on consolidated earnings for the period in question in addition to a number of other factors, including dividends, employees’ bonus level, other companies’ executive bonuses, medium- to longterm operating performance and previous bonus payment amounts.

Stock-based compensation is intended to as an incentive to pursue sustained growth in Toyoda Gosei’s value. It is paid in the form of restricted stock to promote greater sharing of value with shareholders.

Directors’ aggregate annual cash compensation (monthly compensation plus bonuses) is capped at ¥650 million (outside directors’ share of which is capped at ¥65 million). Directors’ aggregate annual restricted stock-based compensation is capped at ¥100 million (outside directors are not eligible for restricted stock-based compensation).

All three compensation caps were approved at the annual shareholders’ meeting on June 12, 2020.

Based on the methods mentioned above, the Board of Directors votes to set compensation within the limits set by shareholder resolution, following a fair and transparent review/reporting process by the majority-independent Executive Compensation Committee chaired by an outside director.

■Director compensation scheme

■Officer compensation

The total compensation for each officer class, the total by each type of compensation, and the number of officers receiving the compensation

| Officer class | Total executive compensation (Millions of yen) |

Total amount by type of compensation (Millions of yen) |

Number of subject officers (People) |

|

|---|---|---|---|---|

| Monthly compensation |

Bonuses | |||

| Directors (excluding outside directors) |

355 | 282 | 73 | 7 |

| Audit & Supervisory Board members (excluding outside members) |

76 | 76 | - | 2 |

| Outside officers | 67 | 67 | - | 6 |

Note: Bonuses are the provision of allowance in the given fiscal year.